Volume Trader Terminal has become an essential tool for traders worldwide, offering unparalleled insights into market dynamics and trading opportunities. Whether you're a beginner or a seasoned trader, understanding the intricacies of this platform can significantly enhance your trading strategy. In this article, we will explore everything you need to know about the Volume Trader Terminal, from its basic functionalities to advanced features.

The financial markets are complex ecosystems that require precise tools for effective navigation. Volume Trader Terminal stands out as one of the most powerful platforms designed to provide traders with the data they need to make informed decisions. With its robust features and real-time analytics, this terminal empowers traders to identify trends, manage risks, and maximize profits.

As we delve deeper into this comprehensive guide, you will discover how Volume Trader Terminal can transform your trading experience. From understanding its core functionalities to implementing advanced strategies, this article will equip you with the knowledge and skills necessary to succeed in the competitive world of trading.

Read also:Natalnya Leaks A Comprehensive Exploration Of The Phenomenon

What is Volume Trader Terminal?

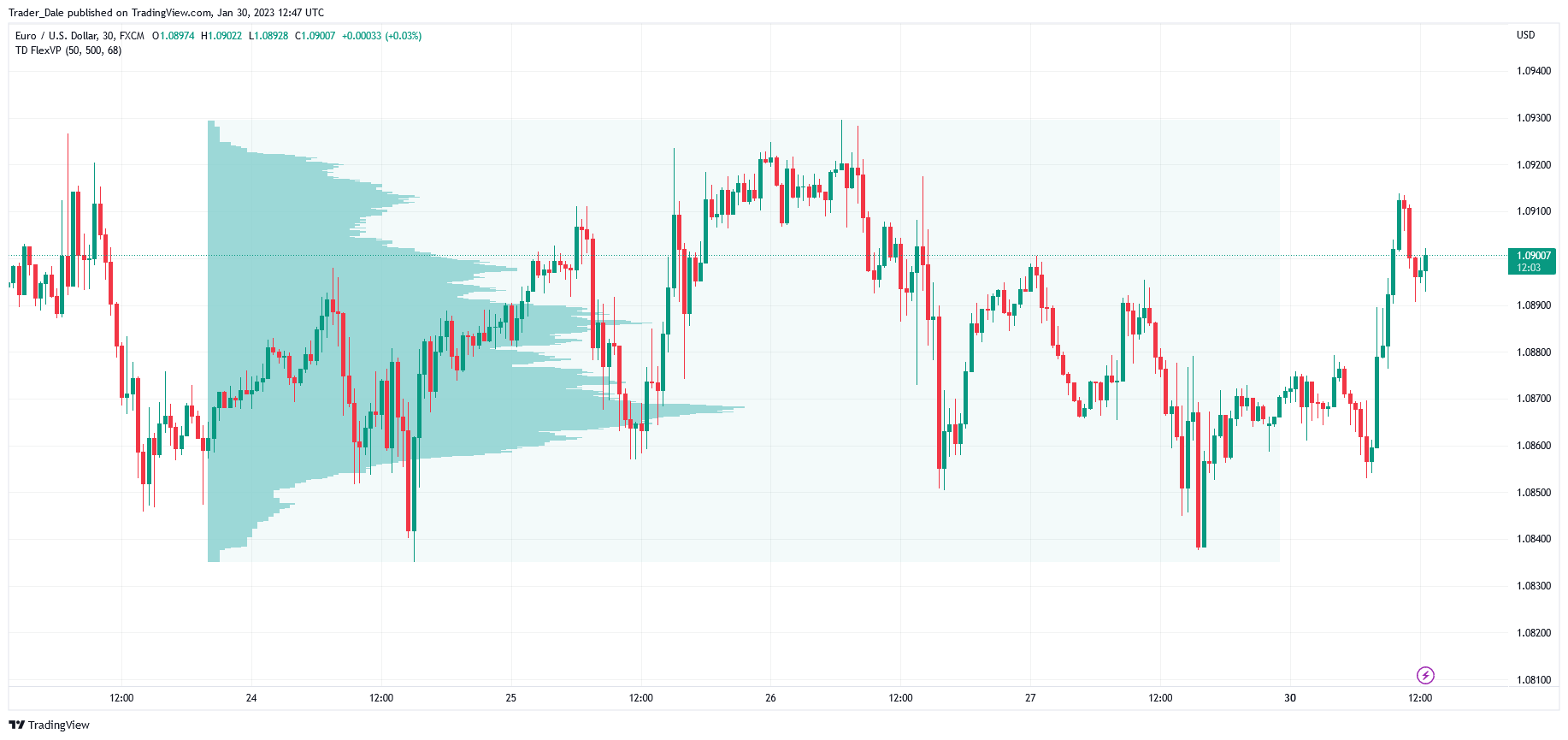

Volume Trader Terminal is a cutting-edge trading platform designed to assist traders in analyzing market volume and executing trades efficiently. It provides users with real-time data, advanced charting tools, and customizable indicators to enhance their trading performance. This terminal is especially valuable for those who rely on volume-based strategies to identify profitable trading opportunities.

The platform offers a user-friendly interface that allows traders to monitor multiple markets simultaneously. By integrating various data streams, Volume Trader Terminal enables users to gain deeper insights into market behavior and make data-driven decisions. Its versatility makes it suitable for both novice traders and experienced professionals seeking to refine their strategies.

Key Features of Volume Trader Terminal

- Real-time market data

- Advanced charting tools

- Customizable indicators

- Multi-market monitoring

- Volume-based analysis

How Does Volume Trader Terminal Work?

The functioning of Volume Trader Terminal revolves around its ability to aggregate and analyze vast amounts of market data. By leveraging sophisticated algorithms, the platform processes trading volume information to generate actionable insights. Traders can use these insights to identify trends, assess market sentiment, and execute trades with precision.

The terminal's workflow typically involves three key stages: data collection, analysis, and execution. In the data collection phase, the platform gathers real-time information from various exchanges and financial institutions. During the analysis phase, this data is processed using advanced algorithms to produce meaningful patterns and signals. Finally, in the execution phase, traders can act on these insights by placing trades directly through the platform.

Understanding Market Volume

Market volume is a critical metric in trading, representing the total number of shares or contracts traded during a specific period. Volume Trader Terminal excels at interpreting this metric by providing traders with tools to visualize and analyze volume patterns. By understanding market volume, traders can better gauge the strength of price movements and predict future trends.

Benefits of Using Volume Trader Terminal

Adopting Volume Trader Terminal offers numerous advantages that contribute to a trader's success. Firstly, the platform's real-time data capabilities ensure that traders are always up-to-date with the latest market developments. Secondly, its advanced charting tools and customizable indicators empower users to tailor the platform to their specific needs. Lastly, the terminal's intuitive interface makes it accessible to traders of all skill levels.

Read also:Manninos Bakery A Sweet Haven For Every Pastry Lover

Some of the key benefits include:

- Enhanced market analysis

- Improved trading efficiency

- Increased profitability

- Reduced decision-making risks

Advantages Over Traditional Platforms

Compared to traditional trading platforms, Volume Trader Terminal offers several distinct advantages. Its focus on volume-based analysis provides traders with a unique perspective on market dynamics, enabling them to identify opportunities that may be overlooked by conventional tools. Additionally, the platform's real-time data capabilities ensure that traders are always working with the most current information.

Setting Up Volume Trader Terminal

Getting started with Volume Trader Terminal is a straightforward process that involves a few essential steps. First, users must download and install the platform from the official website. Once installed, traders can create an account and log in to access the terminal's features. From there, they can customize the interface to suit their preferences and begin exploring the platform's functionalities.

To fully harness the platform's potential, it is recommended that users take advantage of the available tutorials and resources. These materials provide valuable guidance on how to use the terminal effectively and maximize its benefits. By investing time in learning the platform's capabilities, traders can enhance their trading strategies and achieve greater success.

Customization Options

Volume Trader Terminal offers a wide range of customization options that allow users to tailor the platform to their specific needs. Traders can adjust chart settings, add custom indicators, and create personalized layouts to optimize their trading experience. This level of flexibility ensures that the platform can adapt to the unique requirements of each user.

Advanced Strategies Using Volume Trader Terminal

For experienced traders, Volume Trader Terminal provides the tools necessary to implement advanced strategies and refine their approach to trading. By leveraging the platform's advanced features, users can develop sophisticated algorithms and automate their trading processes. This enables them to focus on higher-level decision-making while the terminal handles the technical aspects of trading.

Some popular advanced strategies include:

- Volume-weighted average price (VWAP) analysis

- Volume profile construction

- Delta-neutral trading

Integrating Algorithms

Volume Trader Terminal supports algorithmic trading, allowing users to integrate custom algorithms into their trading strategies. This feature enables traders to automate repetitive tasks, such as order placement and risk management, freeing up time for more strategic activities. By combining algorithmic trading with the platform's volume-based analysis, traders can achieve greater efficiency and consistency in their operations.

Best Practices for Using Volume Trader Terminal

To ensure optimal performance when using Volume Trader Terminal, it is essential to follow best practices. These practices include maintaining up-to-date software, regularly reviewing trading performance, and staying informed about market developments. By adhering to these guidelines, traders can maximize the platform's benefits and improve their overall trading outcomes.

Some additional best practices include:

- Setting clear trading goals

- Managing risk effectively

- Continuously educating oneself

Risk Management Techniques

Effective risk management is crucial for successful trading, and Volume Trader Terminal provides several tools to assist with this process. Traders can use stop-loss orders, position sizing, and other risk management techniques to protect their capital and minimize potential losses. By incorporating these strategies into their trading plans, users can enhance their long-term success and sustainability.

Common Challenges and Solutions

While Volume Trader Terminal is a powerful tool, it does come with some challenges that traders may encounter. These challenges include technical issues, learning curves, and market volatility. However, with the right approach, these obstacles can be overcome, allowing users to fully realize the platform's potential.

To address these challenges, traders can:

- Seek support from the platform's customer service team

- Engage in continuous learning and skill development

- Adopt flexible strategies to adapt to changing market conditions

Technical Troubleshooting

Technical issues can arise when using any trading platform, and Volume Trader Terminal is no exception. To resolve these problems, traders should ensure that their systems meet the platform's requirements and keep their software updated. Additionally, consulting the platform's support resources can provide valuable guidance on resolving common technical issues.

Conclusion and Call to Action

In conclusion, Volume Trader Terminal is a powerful tool that can significantly enhance a trader's ability to analyze markets and execute trades effectively. By understanding its features and implementing best practices, traders can unlock the platform's full potential and achieve greater success in their trading endeavors. The key to success lies in continuous learning, adaptability, and effective risk management.

We encourage readers to explore the capabilities of Volume Trader Terminal further and apply the knowledge gained from this article to their trading strategies. Feel free to share your thoughts and experiences in the comments section below, and don't hesitate to reach out with any questions or feedback. For more informative content, be sure to explore our other articles and resources.

Table of Contents

- What is Volume Trader Terminal?

- How Does Volume Trader Terminal Work?

- Benefits of Using Volume Trader Terminal

- Setting Up Volume Trader Terminal

- Advanced Strategies Using Volume Trader Terminal

- Best Practices for Using Volume Trader Terminal

- Common Challenges and Solutions

- Conclusion and Call to Action